Ezequiel Garcia-Lembergman

Assistant Professor at Pontificia Universidad Católica de Chile

I got my PhD in Economics at University of California, Berkeley in 2021.

My research interests are in international economics, development economics, and environmental economics. My CV is here, and a description of my research is here.

Contact me

-

Name:Ezequiel Garcia Lembergman

-

Email:

Fields

International Economics, Development Economics, and Environmental Economics.

Research

Working papers

Multi-establishment Firms, Pricing and the Propagation of Local Shocks: Evidence from US Retail. Accepted, Review of Economics and Statistics

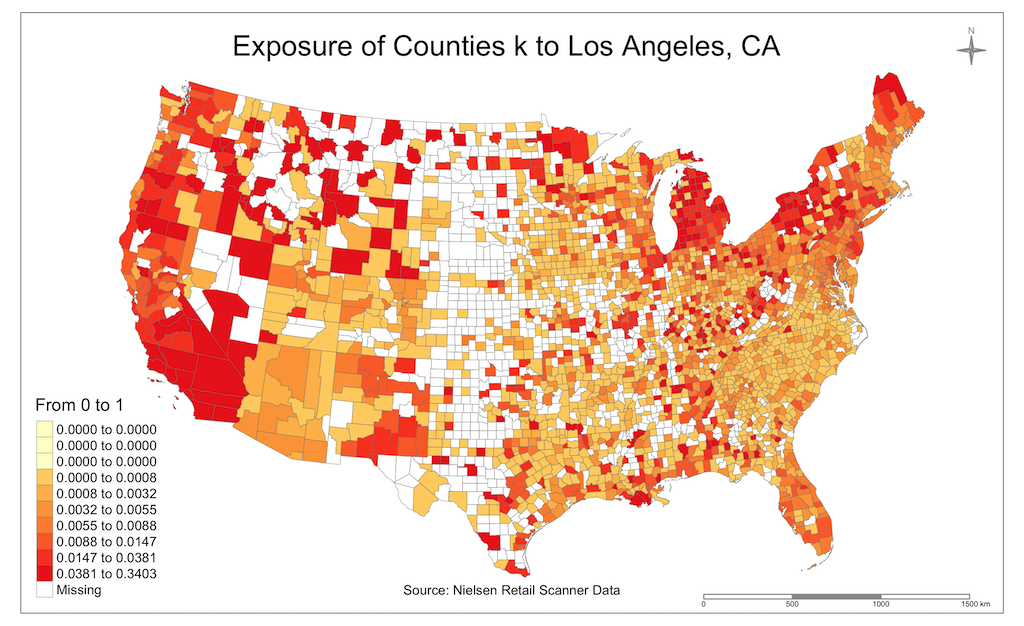

I study whether and how retail chains and their geographic distribution of stores contribute to the propagation of shocks across regions in the United States. Linking detailed store scanner micro-data to a county-level house price dataset for the period of the Great Recession, I investigate the spread of house-price induced local shocks through the networks of retail chains. My main empirical finding is that county-level prices are sensitive to shocks in distant counties that happen to be served by the same retail chains. A 10% drop in house prices in other counties that are served by the same retailers leads, on average, to a 1.4% decline in the local consumer retail price index. My results hold after conditioning on trade relationships due to geographic proximity. In fact, I document that once the retail chains' networks are controlled for, there is no additional role for propagation of shocks across nearby regions. Finally, while the network of retail chains is an important determinant of the effect local shocks have on consumer prices, it does not affect wages in distant regions, which suggests that the network of retail chains affects consumers' real income. I rationalize the reduced-form estimates in a model in which retail chains vary prices uniformly across their stores as a function of changes in market demand that they face at the (aggregate) chain level. I find that the calibrated model with uniform pricing can fully account for the reduced-form effects. Counterfactual analysis shows that uniform pricing and the geographic distribution of retail chains reduced cross-county dispersion in inflation by 40% during the Great Recession, benefiting consumers from low-income counties that were less exposed to drops in local house prices.

Importing After Exporting, with Facundo Albornoz. Revise and resubmit, Journal of European Economic Association.

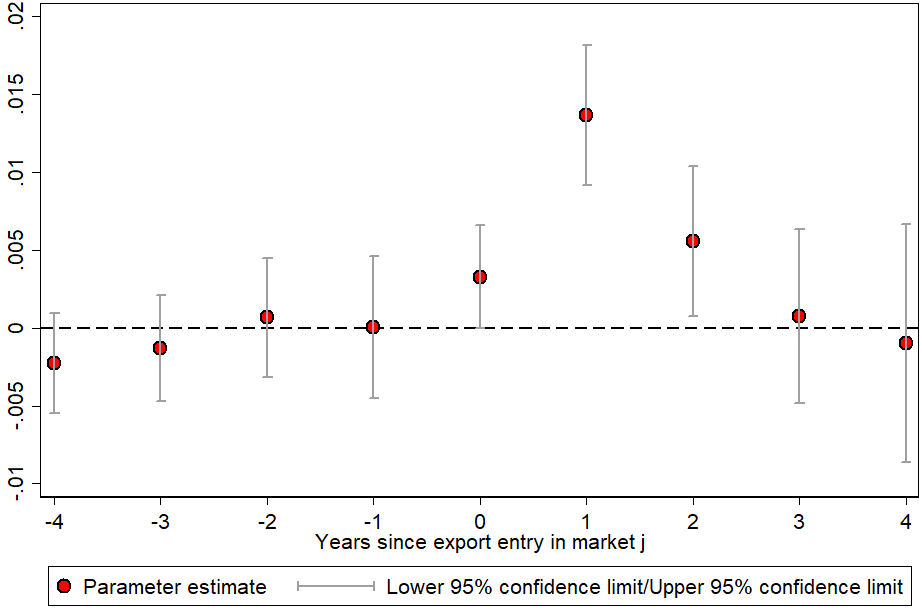

We uncover a novel fact about the relationship between exporting and importing. Using a comprehensive database of Argentine firms, we find that exporting to a new destination increases the probability of a firm beginning to import from that market within the lapse of one year. We develop a model of import and export decisions to study the effect of productivity and import costs on the intensive and extensive margins of importing. We show that "importing after exporting" implies that export entry reduces the cost of importing from that market. This effect is more likely to occur in distant markets, and in situations where importing involves non-homogeneous and rarely imported goods. Furthermore, new import activities from a new export destination continue regardless of whether the firm remains as an exporter in that market. This evidence is consistent with exporting reducing the information costs of importing. The effect of export entry on sourcing costs has implications that go beyond qualitative insights: according to our quantitative exercise, import costs fall 53% in a given destination after export entry, and the estimated import-cost savings increase for distant markets outside the Americas.

The Expectations of others, with Ina Hajdini, John Leer, Mathieu Pedemonte, and Raphael Schoenle. Revise and Resubmit, American Economic Journal: Macroeconomics.

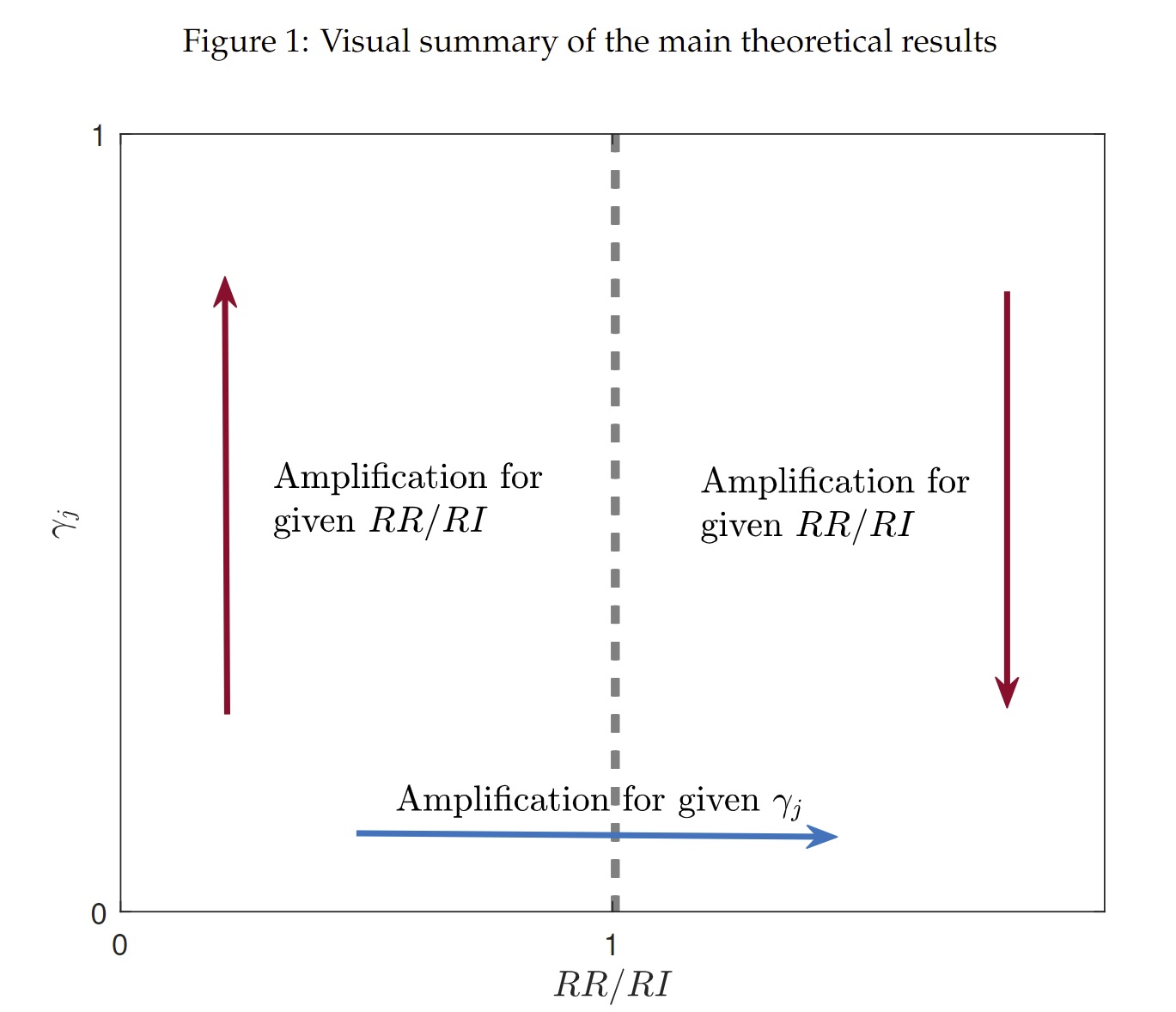

Using a novel dataset that integrates inflation expectations with social networkconnections, we show that inflation expectations within one’s social network have a positive, causal relationship with individual inflation expectations. This relationship is stronger for groups that share commondemographic characteristics such as gender, income, or political affiliation and when salient information is shared. In a monetary-union New-Keynesian model, trade networks and socially determined inflation expectations induce imperfect risk-sharing, and can affect the inflation and real output propagation of local and aggregate shocks. To reduce welfare losses, monetary policy should optimally put more weight on the inflation rate of socially more connected regions.

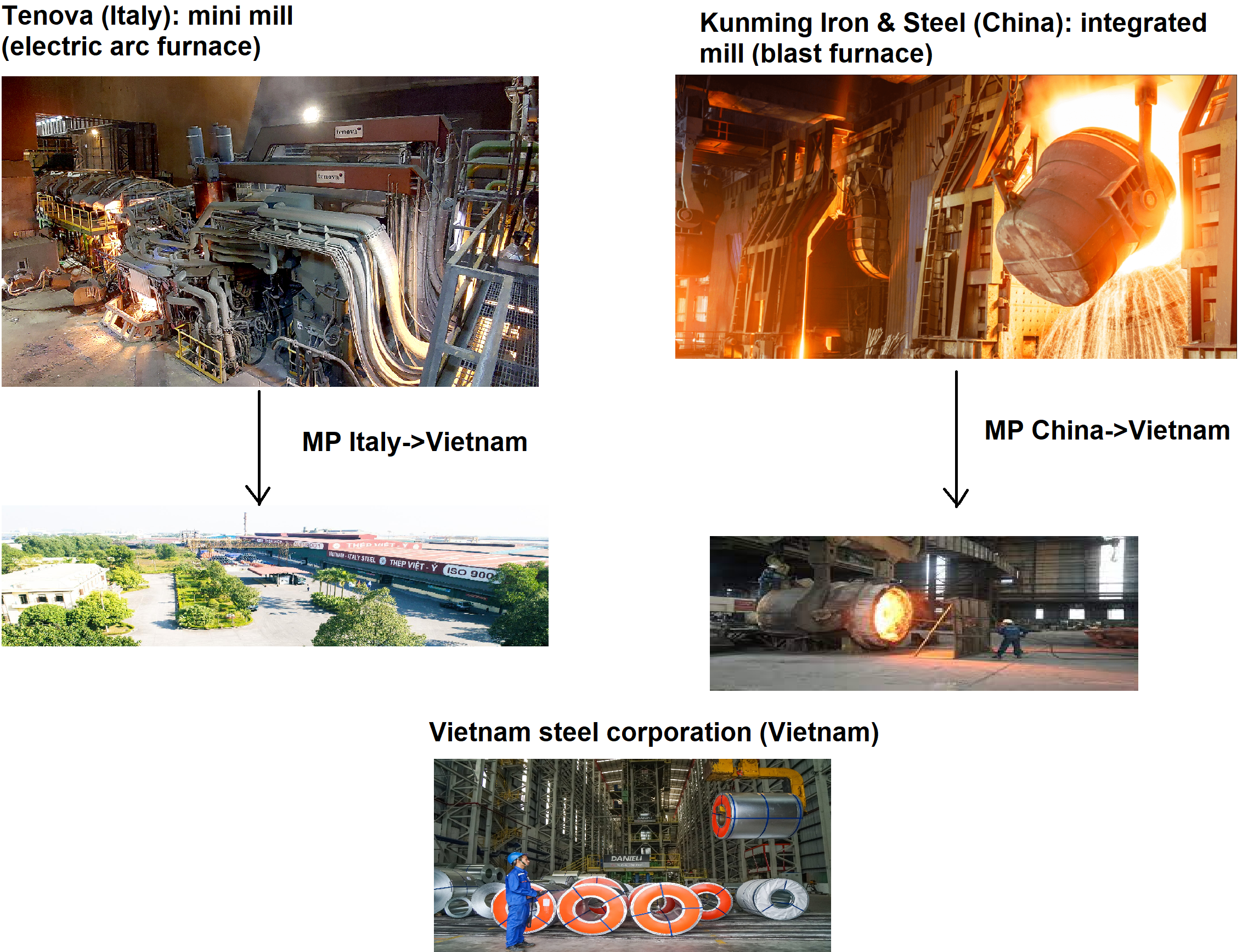

The Carbon Footprint of Multinational Production, with Natalia Ramondo, Andres Rodriguez-Clare, and Joseph Shapiro.

How does multinational production affect climate change? Global climate negotiations have set the goal of enormous transfers per year from rich to poor countries, including through private investment, to address climate change. Two stylized facts motivate the analysis of multinational production as a mechanism for such transfers. First, carbon emissions per dollar of value added or output differ substantially across countries, even conditional on industrial composition. Second, the emissions rate of a foreign-owned plant increases with the emission rate of its home country, suggesting that firms bring green technology with them when operating abroad. We develop and quantify a multi-country general equilibrium model of multinational production, trade, and energy to assess how policies encouraging multinational production would affect global carbon emissions and welfare.

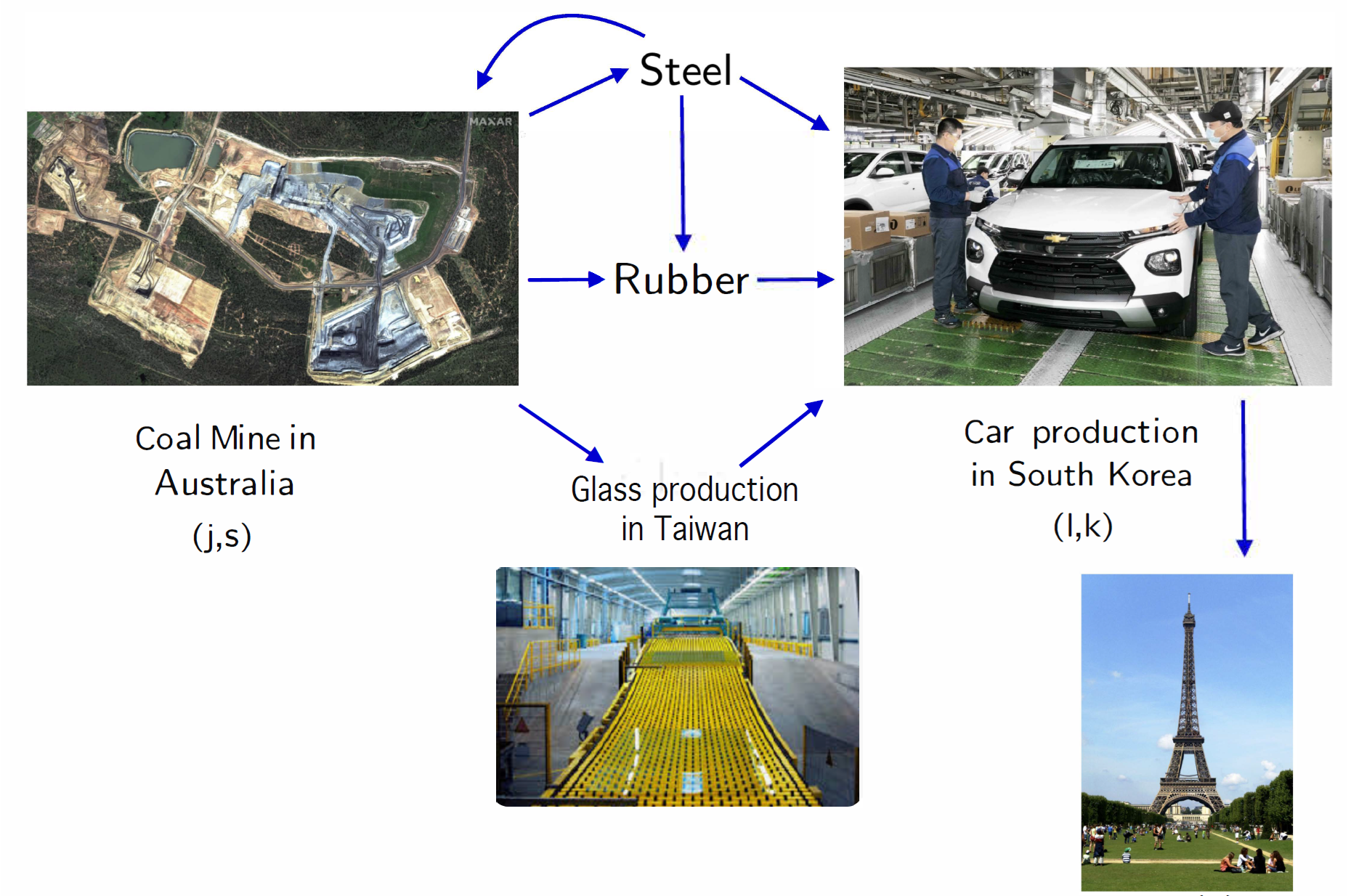

Quantifying Emissions in the Global Economy, with Natalia Ramondo, Andres Rodriguez-Clare, and Joseph Shapiro.

We develop a quantitative trade model incorporating fossil fuel markets and carbon emissions. Using engineering estimates of mining extraction costs, we estimate the supply elasticity of fossil fuels and use the model to study how trade shocks and carbon taxes affect emissions, real income, and welfare. We consider three alternative Pigouvian taxes that differ only in the point of implementation: an extraction tax on fossil fuel mining, a production tax on the direct use of fossil fuels, and a consumption tax on the direct and indirect use of fossil fuels along global value chains. Global versions of the three taxes have similar global consequences and differ only via terms-of-trade effects; for example, fuel net exporters benefit more from global extraction taxes. For all three policies, a Pigouvian tax with the social cost of carbon equal to $100/ton decreases global emissions by 45% and real income by 0.6%, and increases global welfare 1.5%. We also characterize globally efficient unilateral taxes as a simple function of resulting leakage. The optimal unilateral production tax induces substantial leakage, motivating border adjustments. A unilateral consumption tax, with lower leakage, has a higher optimal tax level and welfare gain. Pairing a consumption and extraction tax outperforms either policy alone; for US or EU unilateral policy, this pairing increases global welfare gain by 40% relative to a consumption tax alone.

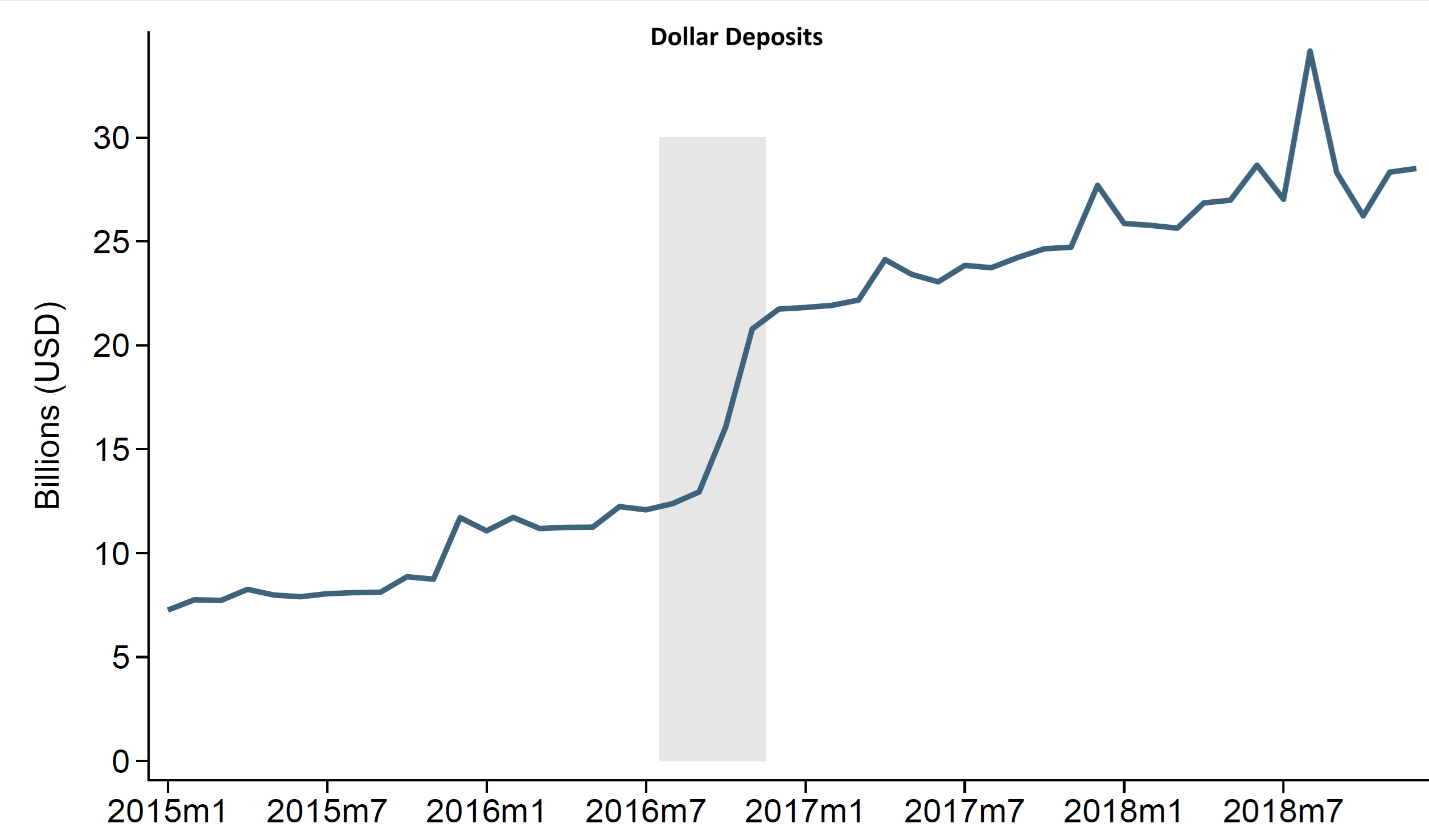

The Financial Channel of Tax Amnesty Policies , with Federico Bernini, Paula Donaldson, and Leticia Juarez.

In the past two decades, over 30 countries have implemented tax amnesty policies to encourage the declaration and repatriation of hidden assets, with the goal of increasing government tax revenues. While previous literature has primarily focused on the fiscal impact, this paper studies a new channel: the potential expansion of the financial sector resulting from these policies. We examine the macroeconomic effects of Argentina’s 2016 Tax Amnesty, one of the largest programs for disclosing hidden assets, through the financial channel. This amnesty led to an influx of cash holdings into domestic banks, primarily in dollars, equivalent to 50% increase in dollar deposits. We leverage the heterogeneous exposure of banks and firms to this amnesty-induced financial shock to identify bank responses and the spillovers to firms in the private sector. We find that more exposed banks significantly increased their lending compared to less exposed ones. Firms connected to banks with higher exposure experienced increased borrowing, along with a boost in imports, exports and employment. Our findings reveal that tax amnesty policies can stimulate economic growth by expanding the financial sector, demonstrating effects beyond their direct fiscal impact. These results are particularly relevant for countries with underdeveloped financial systems, where the potential for growth through improved access to capital is significant.

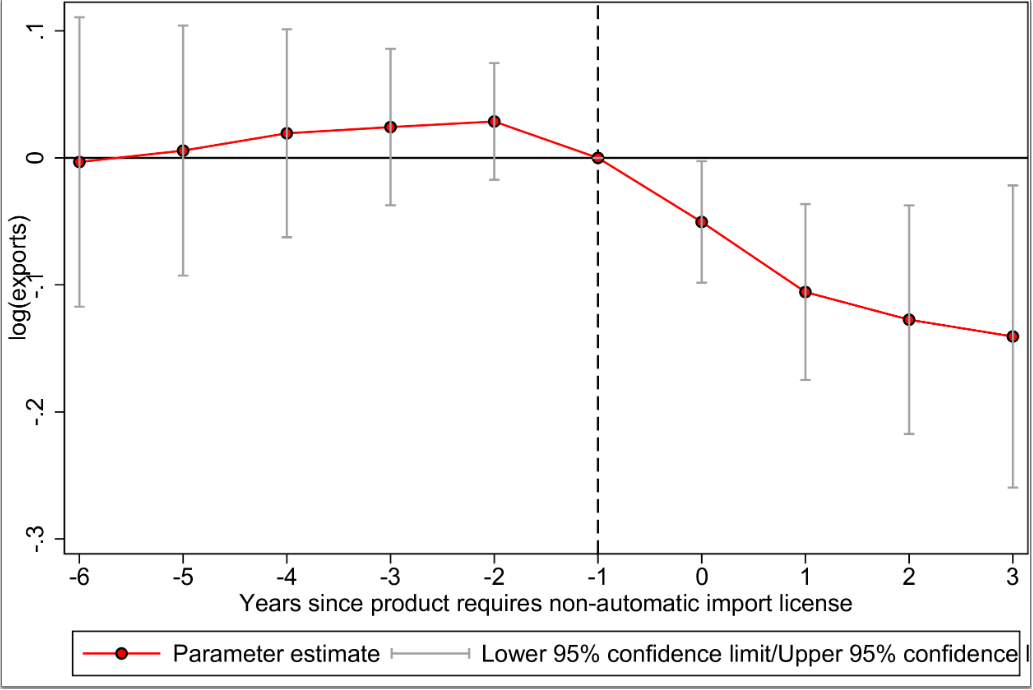

The Downstream Consequences of Non-Tariff Trade Barriers: Theory and Evidence from Import Licenses in Argentina , with Federico Bernini, and Leticia Juarez.

As WTO regulations rendered tariffs less viable, the trade policy landscape experienced a significant transformation: Non-tariff barriers have proliferated, becoming a central instrument of countries’ trade policy. How do Non-Tariff import Barriers affect downstream firms? What role do firm market power and market concentration play in shaping the effects of these barriers? This paper investigates the effects of import licenses (NAILs) in Argentina from 2005 to 2011. We construct a novel database with yearly data on products that require import licenses to analyze the causal effects of NAILs on firms’ imports, exports, and employment. Our empirical strategy leverages the staggered introduction of NAILs as a unique opportunity for causal identification. We find that NAILs significantly reduce firm imports, leading firms reliant on these imported inputs to decrease exports and employment. In a trade model with oligopolistic competition in export markets, we provide conditions under which firms’ market power can shape the aggregate impact of NAILs. In markets where a firm is relatively large, it can respond to NAILs by adjusting its markups while maintaining relatively stable prices and output. This reduces the overall impact on consumer prices in more concentrated markets.

Other Writing

VoxDevLit Review: Foreign Direct Investment and Development, with Stefania Garetto, Nina Pavnik, Natalia Ramondo, Vanessa Alviarez, Laura Boudreau, Evangelina Dardati, Jingting Fan, Farid Farrokhi, Grace Gu, Galina Hale, David Hemous, Nicola Limodio, Isabela Manelici, Nicolas Morales, Ralf Martin, Nitya Pandalai-Nayar, Heitor Pellegrina, Jose Vasquez, and Pierre Vezina.

Work in Progress

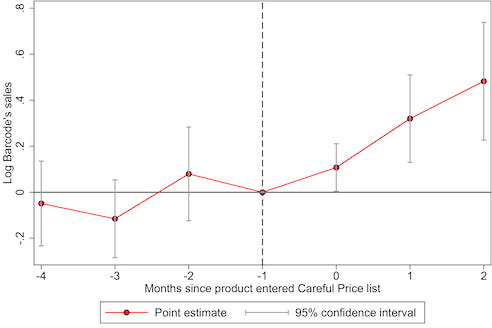

"Price controls, market power and inequality on consumption baskets: evidence from retail scanner data in Argentina", with Bernardo Diaz-Astarola and Dario Tortarolo.

We study the efficiency and distributional effects of an unusual price controls policy implemented in Argentina. There are two interesting features from the program that makes it different from standard price control programs. First, the participation of firms was voluntary. Second, participant products were advertised by the government in stores, which provided incentives for the firms to enter the program. We exploit scanner data and variation from price regulations introduced in the Argentine retail sector. We first present descriptive evidence on the effect of price controls on the supply of targeted products, spillovers on similar products, and explore how it differs by the level of concentration in the product's industry. Firms that entered the program reduced their prices, increased their sales volume, and there is no evidence of shortages. We then develop a model to study the general equilibrium effects of the policy. In the model, access to cheap advertisement works as an incentive for the firms to endogenously enter to the program. This incentive is larger for smaller firms. We use the model to quantify the distributional and welfare effects of this policy, under alternative scenarios.

Publications

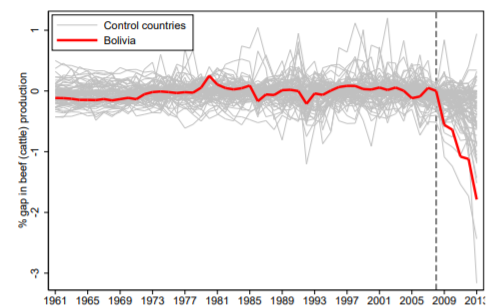

The impact of export restrictions on production: A synthetic controls approach, with Martin Rossi & Rodolfo Stucchi. Journal of Latin American and Caribbean Economic Association, 2018.

In spite of the generalized use of quantitative restrictions on exports, there is little empirical research on their effectiveness to achieve the intended effects of reducing exports, increasing production for domestic markets, and reducing domestic prices. This paper aims at filling this gap by estimating the impact of quantitative restrictions on cattle beef exports in Bolivia, applying a synthetic controls approach. Our main finding is that export restrictions have a negative impact not only on total production, but also on production for the domestic market. This fact, together with an increase in the domestic price, is consistent with a supply shift. The fact that export controls can shift supply and actually harm production for domestic markets bears important implications for the design of policies in the future.

Microeconomic dimensions of an export boom: Argentina, 2003-2011, with Facundo Albornoz and Leticia Juarez. The World Economy Journal, 2018.

This paper examines Argentine exports at the firm level between 2003 and 2011, a period of exceptional and sustained export growth. While at the product level, the pattern of specialization barely changed, exporters exhibit new dynamics in international markets: firms not only expanded sales abroad by increasing their exports in existing markets, but also by entering into new destinations and adding new products. That is, new export strategies allowed exporters achieve greater resistance to the variations in the macroeconomic environment. We find that the importance of the different export margins changes overtime: while the currency is depreciated, the intensive margin explains most of export growth, whereas the subextensive and extensive margins become the main source of export growth once the currency appreciates. We also uncover a strong complementarity between import and export growth.